Abbeville County Real Estate Tax Rate . for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. how does abbeville county compare? abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. welcome to the abbeville county assessor’s office. We hope that you will find the information on our site to be useful to you. Our abbeville county property tax calculator can estimate your property taxes based on similar. The table below shows the median home value,. an effective tax rate represents the amount homeowners actually pay as a percentage of home value.

from www.formsbank.com

an effective tax rate represents the amount homeowners actually pay as a percentage of home value. for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. Our abbeville county property tax calculator can estimate your property taxes based on similar. We hope that you will find the information on our site to be useful to you. The table below shows the median home value,. Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. how does abbeville county compare? welcome to the abbeville county assessor’s office. abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online.

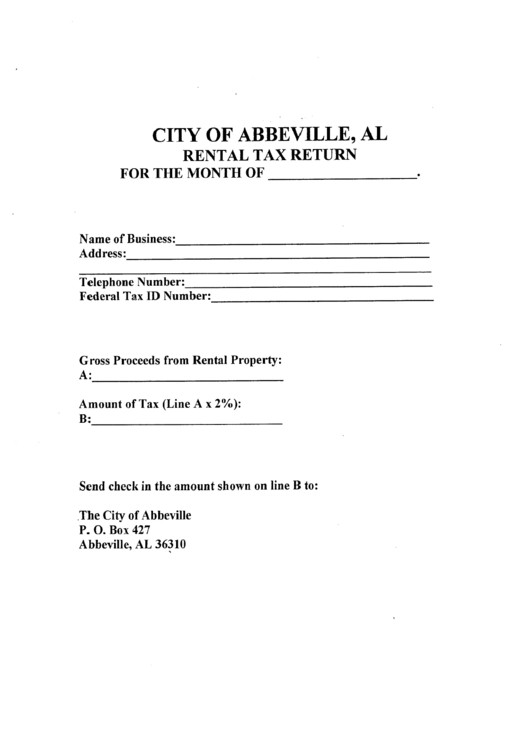

Top 6 City Of Abbeville, Al Tax Forms And Templates free to download in PDF format

Abbeville County Real Estate Tax Rate welcome to the abbeville county assessor’s office. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. The table below shows the median home value,. Our abbeville county property tax calculator can estimate your property taxes based on similar. welcome to the abbeville county assessor’s office. an effective tax rate represents the amount homeowners actually pay as a percentage of home value. abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. how does abbeville county compare? We hope that you will find the information on our site to be useful to you. for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle.

From www.landwatch.com

Abbeville, Abbeville County, SC Undeveloped Land for sale Property ID 416442669 LandWatch Abbeville County Real Estate Tax Rate how does abbeville county compare? an effective tax rate represents the amount homeowners actually pay as a percentage of home value. Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. Our abbeville county property tax calculator can estimate your property taxes based on similar. The table below shows the median home value,. . Abbeville County Real Estate Tax Rate.

From lao.ca.gov

Understanding California’s Property Taxes Abbeville County Real Estate Tax Rate for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. Our abbeville county property tax calculator can estimate your property taxes based on similar. abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. an effective tax rate. Abbeville County Real Estate Tax Rate.

From www.cloudseals.com

nebraska property tax rates by county Abbeville County Real Estate Tax Rate welcome to the abbeville county assessor’s office. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. Abbeville county (0.57%) has a 7.5% higher. Abbeville County Real Estate Tax Rate.

From dorriqmaryann.pages.dev

Federal Estate Tax Rates 2024 Norah Annelise Abbeville County Real Estate Tax Rate an effective tax rate represents the amount homeowners actually pay as a percentage of home value. how does abbeville county compare? abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. We hope that you will find the information on our site to be useful to you. . Abbeville County Real Estate Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Abbeville County Real Estate Tax Rate the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. We hope that you will find the information on our site to be useful to you. Our abbeville county property tax calculator can estimate your property taxes based on similar. for your convenience abbeville county. Abbeville County Real Estate Tax Rate.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Abbeville County Real Estate Tax Rate an effective tax rate represents the amount homeowners actually pay as a percentage of home value. The table below shows the median home value,. welcome to the abbeville county assessor’s office. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. We hope that. Abbeville County Real Estate Tax Rate.

From www.realtor.com

Abbeville County, SC Real Estate & Homes for Sale Abbeville County Real Estate Tax Rate abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. an effective tax rate represents the amount homeowners actually pay as a percentage of home value. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home. Abbeville County Real Estate Tax Rate.

From florenciawhaley.pages.dev

Property Tax By State 2024 Almeta Consuelo Abbeville County Real Estate Tax Rate abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. how does abbeville county compare? We hope that you will find the information on our site to be useful to you. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year,. Abbeville County Real Estate Tax Rate.

From www.formsbank.com

Fillable City Of Abbeville Rental Tax Form printable pdf download Abbeville County Real Estate Tax Rate for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. The table below shows the median home value,. We hope that you will find the information on our site to be useful to you. abbeville county is now providing the ability to search, view, and pay your current. Abbeville County Real Estate Tax Rate.

From www.realtor.com

Abbeville County, SC Real Estate & Homes for Sale Abbeville County Real Estate Tax Rate The table below shows the median home value,. how does abbeville county compare? abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. We hope. Abbeville County Real Estate Tax Rate.

From showmeinstitute.org

Map of Commercial Property Tax Surcharges in Missouri Show Me Institute Abbeville County Real Estate Tax Rate an effective tax rate represents the amount homeowners actually pay as a percentage of home value. Our abbeville county property tax calculator can estimate your property taxes based on similar. for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. The table below shows the median home value,.. Abbeville County Real Estate Tax Rate.

From www.realtor.com

Abbeville, MS Real Estate Abbeville Homes for Sale Abbeville County Real Estate Tax Rate how does abbeville county compare? the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. The table below shows the median home value,. Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. Our abbeville county property tax calculator can estimate. Abbeville County Real Estate Tax Rate.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Abbeville County Real Estate Tax Rate an effective tax rate represents the amount homeowners actually pay as a percentage of home value. Our abbeville county property tax calculator can estimate your property taxes based on similar. We hope that you will find the information on our site to be useful to you. abbeville county is now providing the ability to search, view, and pay. Abbeville County Real Estate Tax Rate.

From www.facebook.com

Abbeville County Real Estate Sc Abbeville County Real Estate Tax Rate We hope that you will find the information on our site to be useful to you. how does abbeville county compare? the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. an effective tax rate represents the amount homeowners actually pay as a percentage. Abbeville County Real Estate Tax Rate.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other counties? MoCo360 Abbeville County Real Estate Tax Rate We hope that you will find the information on our site to be useful to you. how does abbeville county compare? the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. an effective tax rate represents the amount homeowners actually pay as a percentage. Abbeville County Real Estate Tax Rate.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Abbeville County Real Estate Tax Rate Abbeville county (0.57%) has a 7.5% higher property tax than the average of south. The table below shows the median home value,. the median property tax (also known as real estate tax) in abbeville county is $434.00 per year, based on a median home value. abbeville county is now providing the ability to search, view, and pay your. Abbeville County Real Estate Tax Rate.

From www.harrisonburghousingtoday.com

Assessments Market Updates, Analysis and Commentary on Abbeville County Real Estate Tax Rate for your convenience abbeville county is now providing the ability to search, view, and pay your current property and vehicle. an effective tax rate represents the amount homeowners actually pay as a percentage of home value. abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. welcome. Abbeville County Real Estate Tax Rate.

From www.ksba.org

Tax Rates Abbeville County Real Estate Tax Rate abbeville county is now providing the ability to search, view, and pay your current property and vehicle taxes online. an effective tax rate represents the amount homeowners actually pay as a percentage of home value. welcome to the abbeville county assessor’s office. We hope that you will find the information on our site to be useful to. Abbeville County Real Estate Tax Rate.